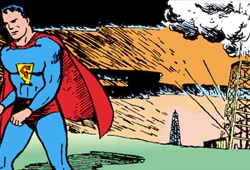

Art by Paul Cassidy and Joe Shuster

In October 1929, the Stock Market crashed, sending the economy spiraling downward and the United States into what is known as the Great Depression. While President Herbert Hoover was unable to curb the tide, the incoming Franklin D. Roosevelt pledged to act decisively upon his election, embracing a liberal philosophy of vast spending on public works programs and the passage of the Banking Act of 1933 and the Social Security Act of 1935.

Amongst the new federal agencies created as part of Roosevelt’s New Deal was the Securities and Exchange Commission. The Security Act of 1933 came first, granting the Federal Trade Commission the authority to oversee the issuance of new securities. This included certification that each new stock was accompanied by relevant financial information and that both companies and their directors were held liable for any misrepresentation.

The following year, President Roosevelt asked Congress for a more inclusive bill to regulate the Stock Exchange. According to historian William E. Leuchtenburg in his 1963 book Franklin D. Roosevelt and the New Deal, the powers previously granted the Federal Trade Commission by the Security Act of 1933 were transferred to a new Securities Exchange Commission under the Securities Exchange Act of 1934. Additional duties were added, including the ability to crack down on insider trading practices and requiring additional disclosure on all securities traded in the United States.

In Action Comics #11, Superman receives a crash course on why such legislation was necessary. On the opening pages of the comic book, newspaper reporter Clark Kent is paying a visit to a local police station when word arrives that a stock investor has committed suicide. Kent tags along with the police to the offices of Meek & Bronson Brokers, the site of the tragedy. “He lost a large sum investing,” Meek explains. “My partner tried to stop the suicide but failed.” Bending over the dead man’s body, Clark Kent finds shares of Black Gold Oil Well clutched in his hands.

At that same moment, another man enters the office and accuses Meek and Bronson of being responsible for the suicide. When Kent questions him about the allegation, the man replies, “They bilked him, myself, and a hundred others out of our life savings by selling us worthless stock.”

Later that night, Clark Kent breaks into the office of Meek & Bronson as Superman and retrieves a copy of all the investors in Black Gold Oil Well. The next day, Kent – taking on a new disguise by not wearing glasses – uses his life savings to buy the stock from everyone who was swindled. He then visits the oil well, pretending to be looking for work.

At first he is greeted with laughter before being told, “Listen pal, there ain’t been no work done on this well for months.” When Kent asks about the oil underneath the land, the man replies, “Maybe there is, and maybe there isn’t. Who knows? But the promoters have found stock selling so profitable they haven’t even bothered to really go after oil.”

In his 1999 book Freedom from Fear: The American People in Depression and War, 1929-1945, David M. Kennedy writes, “Wall Street before the 1930s was a strikingly information-starved environment.” A large percentage of the companies whose stocks were publicly traded either didn’t publish any reports on their operation or arbitrarily edited the reports before releasing them, making them virtually useless. While the likes of legendary financier J.P. Morgan may have been able to obtain reliable information before making an investment, the average American was in essence operating blind. Useful information was even less reliable on the secondary markets, making them ripe for insider manipulation.

The new Security Exchange Commission changed that by mandating balance sheets and profit-and-loss statements – as well as the names of corporate officers and their annual compensation – be made public by all companies openly selling securities. Furthermore, all such information needed to be verified by independent auditors using standardized accounting practices. The days of wildcat stock trading was over, replaced with an ability to make well-informed decisions on what stocks to buy and sell by everyone, not just the rich and powerful.

After being told that no work is available at Black Gold Oil Well, Superman sneaks back after dark and begins constructing the drilling shafts that were apparently purchased but never installed. By dawn, however, the Man of Steel has nothing to show for his efforts. Just as he is about to give up, the rig erupts with a roar and oil comes gushing out the top. Crewmen are able to cap the gusher while the foreman immediately informs Meek and Bronson.

Realizing that they are suddenly rich beyond belief, the two partners decided to buy back the stock they sold before Black Gold Oil Well’s sudden success becomes public knowledge. Since Clark Kent – under the name Homer Ramsey – previously beat them to the punch and now refuses to part with his shares, the pair decide to hire a hitman to kill him. Although unsuccessful, the attempt on his life convinces Ramsey to sell the stock to Meek and Bronson for one million dollars.

Later that night, Superman transports the two owners to the oil well and forces them to watch as he tears it down and sets in on fire, making their stock worthless. “It’s just what you deserved,” he says afterwards. “I’d advise you to quit selling stock or I’ll pay you another visit. From now on, stick to selling shoe-laces.”

Anthony Letizia